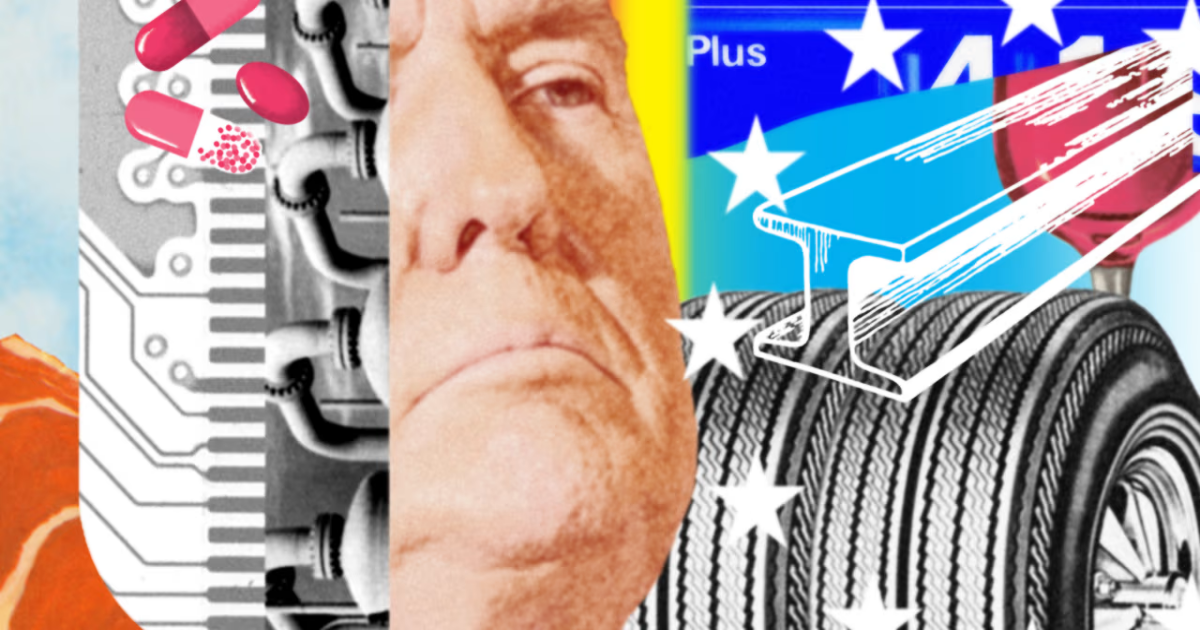

President Trump stepped up his attacks on Jerome Powell, saying the Federal Reserve chair’s “termination cannot come fast enough.”

In an early morning social-media post, the president argued Powell was always late, and the U.S. central bank should have cut rates more aggressively like its main counterpart in Europe. The European Central Bank cut rates a quarter-percentage point Thursday, its seventh cut in eight meetings.

Tensions between the White House and the Fed could unnerve investors who see the bank’s independence as a foundational appeal of U.S. markets. Questions around Fed leadership add a wildcard to markets already struggling to adjust to shifts in trade policy and international relations.

In premarket trading, stocks looked poised to claw back some ground lost in Wednesday’s tech-driven rout. But by midmorning, all three major indexes sipped back into the red. Nvidia shares fell more than 3%.

The Dow Jones Industrial Average led losses, after disappointing results from UnitedHealth sent its stock sliding more than 20%. UnitedHealth’s share price has an outsize effect on the price-weighted Dow index.

The trade war remains in focus, with Trump late Wednesday touting progress in talks with Japan. The country is one of dozens seeking to strike a deal during a 90-day pause to so-called reciprocal tariffs. In a post early Thursday, he said: “Every Nation, including China, wants to meet!”

Aside from UnitedHealth, earnings from American Express, Blackstone and other companies rolled in. TSMC, the world’s largest contract chip maker, posted a bigger-than-expected jump in first-quarter profit.

The Dow Jones Industrial Average dropped 1.5%, while the S&P 500 and the tech-heavy Nasdaq Composite notched smaller losses.

U.S. government bonds fell in price. Ten-year Treasury yields edged up, putting them on track to snap three days of declines.

The WSJ Dollar Index was mostly flat. It has fallen for six of the past seven trading days, a depreciation that has rippled through the world economy.

Global markets were mixed. The Stoxx Europe 600 slipped, while Asian markets broadly rose.

The U.S. stock market is closed tomorrow for Good Friday. The bond market closes early today, at 2 p.m. ET.

📧 Get smarter about markets with our free weekday morning and evening newsletters.

—By Joe Wallace and Hannah Erin Lang