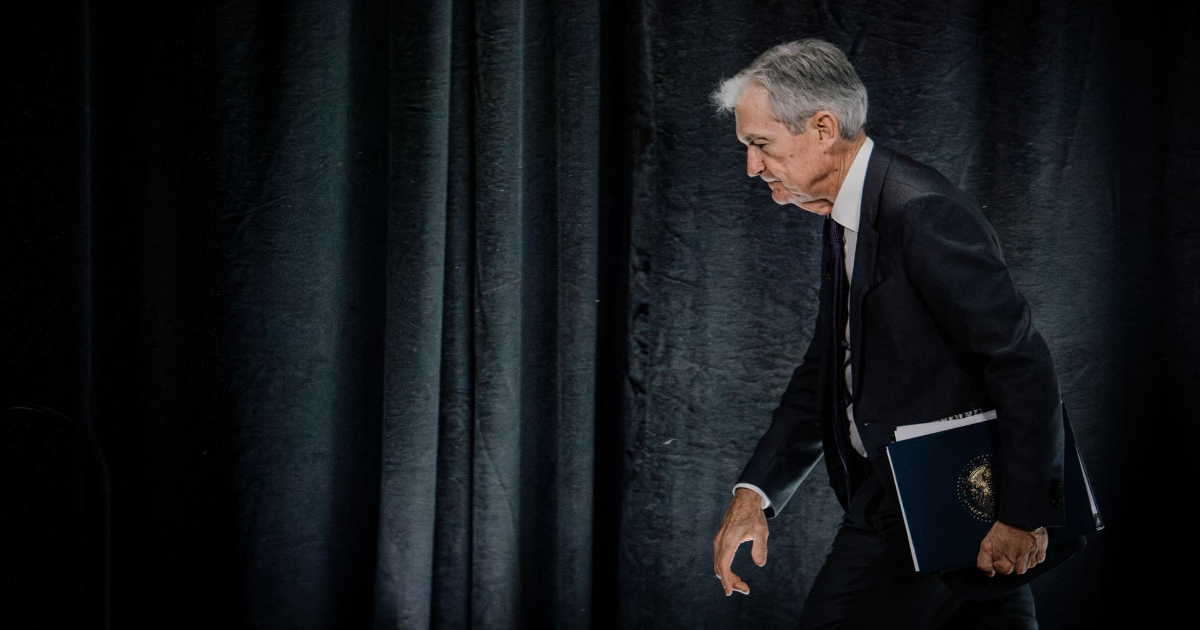

Jerome Powell, chairman of the US Federal Reserve, during an Economic Club of Chicago event in Chicago, Illinois, US, on Wednesday, April 16, 2025.

President Donald Trump on Monday ratcheted up his pressure campaign on Federal Reserve Chairman Jerome Powell, calling him a “major loser” and warning that the U.S. economy could slow down unless interest rates are lowered immediately.

“‘Preemptive Cuts’ in Interest Rates are being called for by many,” Trump wrote on Truth Social.

Trump claimed that there is currently “virtually No Inflation” in the U.S., and that costs for energy and “most other ‘things'” are on the decline.

“With these costs trending so nicely downward, just what I predicted they would do, there can almost be no inflation, but there can be a SLOWING of the economy unless Mr. Too Late, a major loser, lowers interest rates, NOW,” Trump wrote.

Trump’s latest salvo against Powell — whom he appointed during his first administration — came as the president and his team are studying whether they can legally fire the central bank leader before his term expires in May 2026.

Powell has flatly stated that the president cannot remove him under the law.

Any attempt by Trump to fire Powell would likely trigger a steep sell off in U.S. equity markets, Evercore ISI’s vice chairman, Krishna Guha, told CNBC on Monday.

“If you start to raise questions about Federal Reserve independence, you are raising the bar for the Federal Reserve to cut. If you actually did try to remove the Federal Reserve chairman, I think you would see a severe reaction in markets with yields higher, dollars lower and equities selling off,” Guha said on “Squawk Box.”

“I can’t believe that that’s what the administration is trying to achieve,” Guha said.

The stock market, already reeling from heightened uncertainty and other concerns stemming from the Trump administration’s sweeping tariff plans, sank further Monday morning. The Dow Jones Industrial Average tumbled 750 points, a nearly 2% drop, within the first hour of trading, while the Nasdaq fell 2.6%.

The U.S. dollar, meanwhile, slid to its lowest level since 2022. The churn in global markets has sent investors flocking to safe-haven assets such as gold, which hit a record high price on Monday, while the benchmark 10-year Treasury yield crept up.

Trump’s latest attacks on Powell followed the central bank leader’s suggestion last week that the president’s trade war will constrain growth and could fuel inflation.

Tariffs are “likely to move us further away from our goals … probably for the balance of this year,” Powell said at the Economic Club of Chicago.

Powell also stopped short of suggesting that interest rate cuts were on the horizon.

“For the time being, we are well positioned to wait for greater clarity before considering any adjustments to our policy stance,” he said.

— CNBC’s Alex Harring contributed to this report.

Correction: Krishna Guha is vice chairman of Evercore ISI. An earlier version misstated his title.