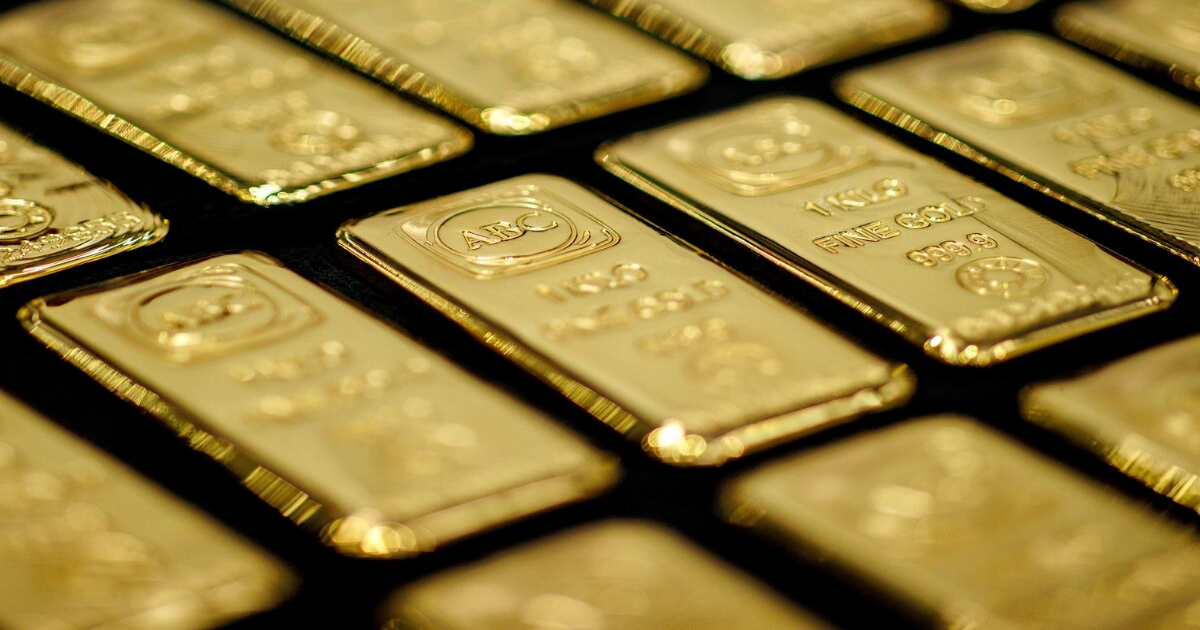

Traders are seeking shelter from the storm. Traditionally, during times of tumult, one might turn to the US dollar and Treasuries. But uncertainty over the trade war and the fear US President Donald Trump could fire Fed Chair Jerome Powell are sending investors to shield not in American assets but in ever-reliable gold, which surged to $3,500 per ounce for the first time, and the yen, which strengthened past the key level of 140 per US dollar for the first time since September. As Lee Liang Le, an analyst at Kallanish Index Services, observes: “Gold’s rapid ascent this year tells me that markets have less confidence in the US than ever.”

Trade talks between India and the US have made “significant progress” over Vice President JD Vance’s trip to India. The two sides have finalized the terms of reference for negotiations on “a new and modern trade agreement,” the White House said. For PM Narendra Modi, the pressure is on to shield Asia’s third-largest economy from disruptions in global trade by striking an early deal with the Trump administration. Barring a trade deal, India faces tariffs of up to 26% on its exports to the US under Trump’s April 2 levies, which are currently on a 90-day pause.