Data: SEC filings, NYSE; Chart: Axios Visuals

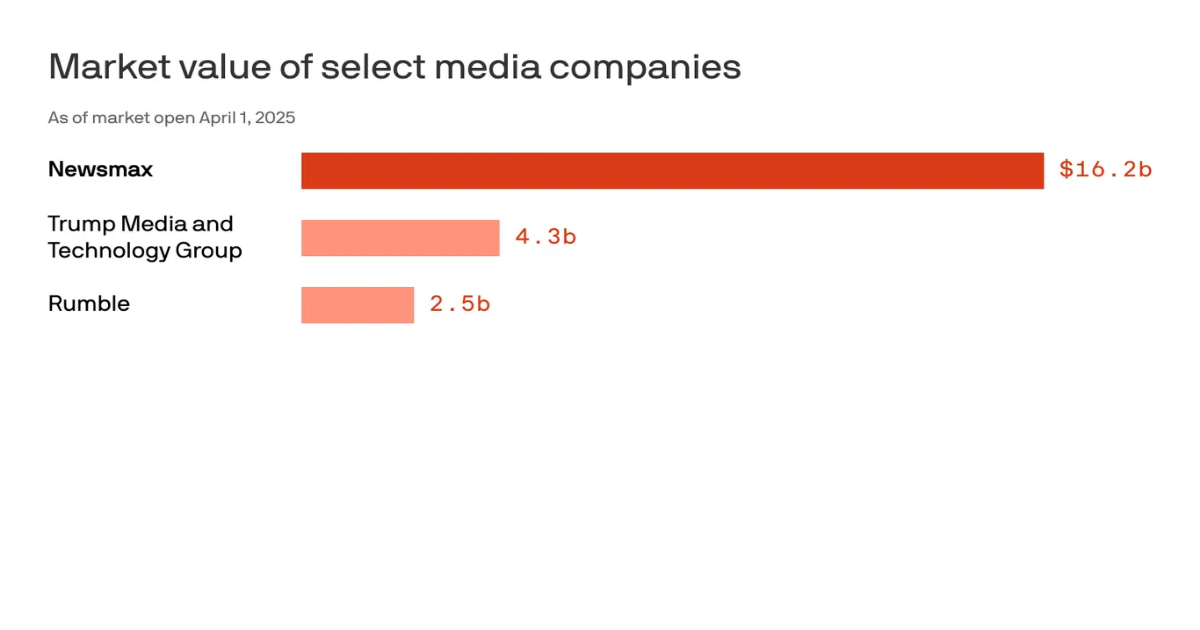

Newsmax, a conservative media company that lost $55 million in the first half of 2024 on revenue of $80 million, was valued at $16.1 billion at market open Tuesday, its second day as a public company.

Context: That’s double the value of the New York Times, which made $106 million in net profit over the same period, on revenue of $1.2 billion.

Why it matters: It’s unusual for a standalone cable news network to go public, especially in this environment, as advertising sales for traditional networks face pressure from streaming.

- But Newsmax has seen its ratings climb in the wake of President Trump’s election.

- Newsmax CEO Chris Ruddy said he discussed the IPO with Trump last week. “I shared with Potus my new saying,” he wrote. “A rising Trump lifts all boats!”

The latest: Investors continued to drive up NMAX Tuesday morning, with the stock trading up another 70%.

Zoom in: Newsmax went public on the NYSE Monday under the stock ticker “NMAX.” The company raised $75 million through the sale of 7.5 million class B common shares at $10 per share last week.

- It also completed a private preferred offering in February, raising $225 million.

Catch up quick: Newsmax launched as a digital outlet more than 25 years ago and expanded into cable in 2014.

- The network gained viewers in the wake of the Jan. 6 Capitol siege following the 2020 election.

- Newsmax was sued by voting tech companies Dominion Voting Systems and Smartmatic over its coverage of the 2020 election. It paid $40 million to settle with Smartmatic.

The big picture: Conservative companies see a financial opportunity to tap into retail investment interest on the public market.

- Last week, online gun retailer GrabAGun merged with Colombier Acquisition Corp. II, a special purpose acquisition company, in anticipation of a summer IPO.

- Colombier is led by Omeed Malik, who is known for backing businesses with conservative values. Malik’s first SPAC, Colombier Acquisition Corp. I, took conservative retail and fintech company PublicSquare public in 2023.

What to watch: Trump Media & Technology Group Corp, the parent company to Truth Social, is up 96.4% since it went public last March.

- Rumble, a video platform akin to YouTube that has attracted conservative voices, is down 29% since it went public in 2022.