Nvidia (NVDA) stock sank as much as 6.9% premarket Wednesday after the AI chipmaker disclosed that it would take a $5.5 billion hit from the US government’s surprise new controls on its semiconductor exports to China.

Nvidia said in a regulatory filing late Tuesday night that the US government informed the company that it would require a special license for exports of its H20 chips made specifically for the Chinese market.

Notably, no licenses for GPU shipments into China have ever been granted given the US government’s concern that the chips could be used to build AI supercomputers in the country. Jefferies analyst Blayne Curtis wrote in an analysis following the news the latest rule is effectively a ban.

NasdaqGS – Delayed Quote • USD

Other Wall Street analysts noted the move was a “surprise,” given a recent report from NPR that the Trump administration had backed off its plans to restrict Nvidia’s H20 chips following a dinner with CEO Jensen Huang at Mar-a-Lago.

Nvidia said it will incur $5.5 billion in charges in its first quarter from the latest curb.

Jefferies’ Curtis projected the company will take an even bigger hit to revenue — $10 billion in lost sales — over the coming quarters. That’s because Curtis said the majority of the writedown is related to finished or partially finished goods, rather than future supply agreements, meaning Nvidia will essentially have to toss out billions worth of now-unsellable chips rather than simply canceling future orders.

“Banning the H20 makes little sense to us,” wrote Bernstein analyst Stacy Rasgon in a note to investors early Wednesday. “H20 performance is low, well below already-available Chinese alternatives; a ban essentially simply hands the Chinese AI market over to Huawei.”

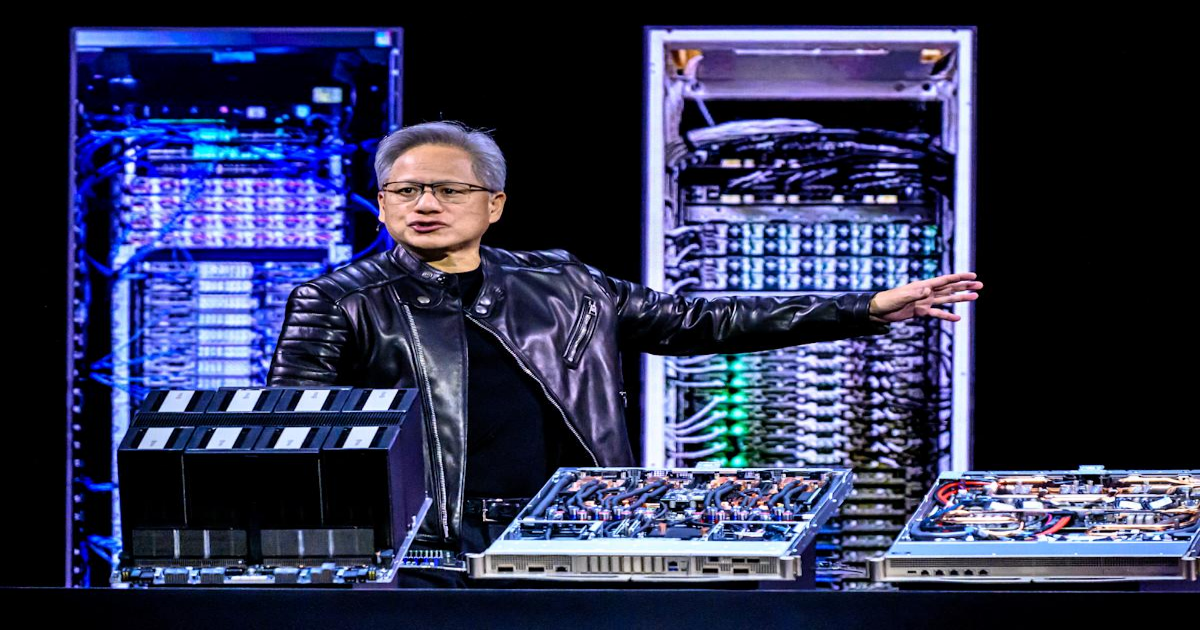

Nvidia CEO Jensen Huang speaks about new products as he delivers the keynote address at the GTC AI Conference in San Jose, California, on March 18, 2025. (Photo by JOSH EDELSON/AFP via Getty Images) · JOSH EDELSON via Getty Images

Raymond James analyst Ed Mills wrote in his own note: “The restrictions on H20 chips comes as a surprise, given explicit approval of the product by the Biden administration and recent media reports that the U.S. government was walking back from banning the product.”

Nvidia has made multiple specialized chips for China since 2022 — the A800, H800, L20, L2 and the H800’s successor H20 — to comply with ever-changing trade rules as the US looks to restrict China’s access to hardware necessary to innovate AI. China accounted for $17 billion, or 13%, of Nvidia’s revenue in its fiscal year 2025, Rasgon noted.

For context, Chinese AI startup DeepSeek said it used roughly 2,000 of Nvidia’s now-banned H800 chips to train its latest artificial intelligence model — a much cheaper feat than OpenAI’s training requirements. DeepSeek’s announcement roiled US markets earlier this year.

“While this is a clear negative, it could be potentially offset by an altering or withdrawal of the country caps on Nvidia chips set to go into effect on May 15,” Raymond James’ Mills wrote.

Mills was referring to the US’ AI Diffusion rule issued by the Biden administration in its final days in January. Nvidia has called on the US government to change what it called a “misguided” set of restrictions.

The White House declined to answer Yahoo Finance’s question over whether it is looking to change or revoke the AI Diffusion rule, but Republican lawmakers sent a letter to Commerce Secretary Howard Lutnick made public Tuesday asking him to toss out the rule.

News of the new curbs on Nvidia H20 chips comes two days after the chipmaker said it will produce up to $500 billion of AI infrastructure in the US within the next four years as the tech industry looks to bolster its domestic manufacturing footprint in the face of Trump’s aggressive approach to trade policy.

Laura Bratton is a reporter for Yahoo Finance. Follow her on Bluesky @laurabratton.bsky.social. Email her at [email protected].

Click here for the latest technology news that will impact the stock market

Read the latest financial and business news from Yahoo Finance