Worry that a slowing economy will derail artificial intelligence-fueled growth this year may take a back seat after Microsoft over-delivered in its latest quarterly earnings report.

Microsoft outpaced Wall Street earnings estimates on revenue and profit, largely thanks to rising AI adoption. The company saw outsized growth in key units, including its cloud business, Azure, and strong Copilot AI adoption.

The better-than-expected results sent Microsoft’s stock price surging 7% in after-hours trading.

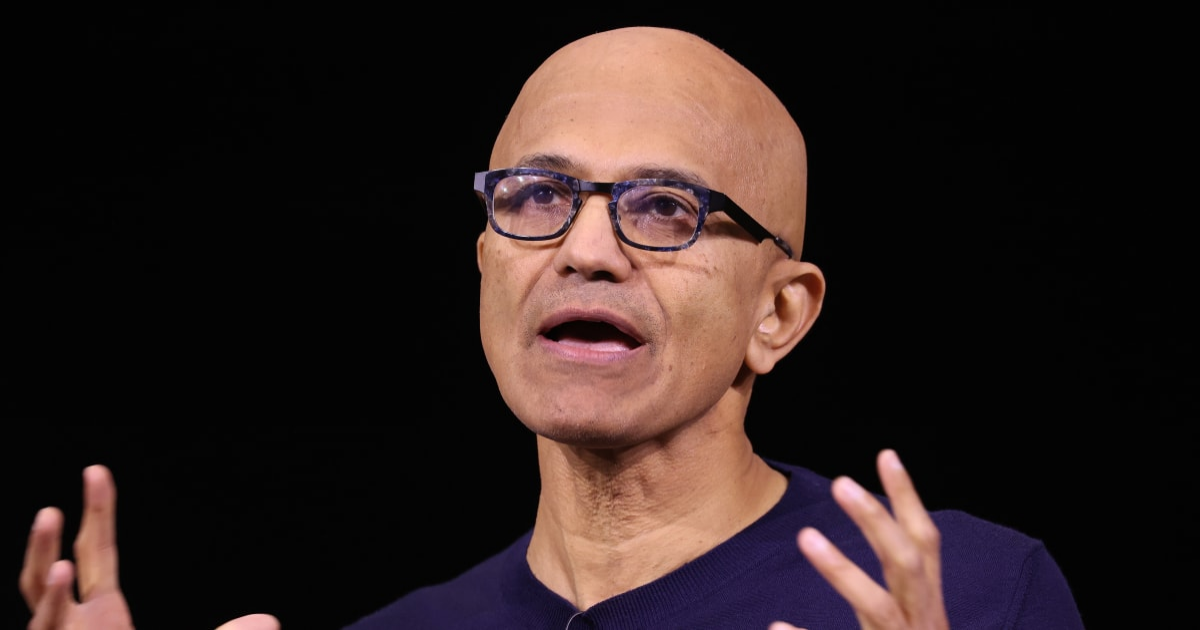

Microsoft CEO Satya Nadella unveiled better-than-expected quarterly earnings results on April 30.

Microsoft continues to ride strong AI tailwinds

Microsoft is one of the most prominent players in artificial intelligence. It has a sweetheart deal with OpenAI’s ChatGPT that accelerated its own AI ambitions, and its AI offering Copilot continues to win rapid seat growth at enterprises.

In the company’s fiscal third quarter, which ended March 31, it generated revenue of $70.06 billion, up 13% year over year, which was $1.62 billion better than Wall Street analysts were modeling.

Its bottom line growth was even more impressive, with earnings per share clocking in at $3.46, 24 cents better than estimates and up 18% from one year ago.

The company’s success was largely due to cloud and AI growth. Microsoft Cloud revenue rose 20% year-over-year to $42.4 billion, while intelligent cloud revenue grew 21% to $26.8 billion, supported by 33% Azure growth. Azure’s growth outpaced the analysts’ 31% growth forecast.

It also posted growth in its other primary segments. Personal computing sales rose 6% to $13.4 billion as search and news ad revenue grew 21%. Productivity and Business Process revenue rose 10% to $29.9 billion.

Investors key in on AI growth and profit expansion

Azure’s performance is helping ease some worry that AI demand may soften amid growing macro risk. Meanwhile, operating performance gains are translating into profit margin growth.

So far, the one-two punch is enough to encourage investors to bid higher shares, reversing some of Microsoft’s 2025 losses. Heading into the report, Microsoft’s stock price was down 6% year-to-date and 10% over the past three months.

The early reaction to Microsoft’s quarterly earnings shows shares up 7.3% in post-market trading. Of course, much depends on how investors react to the company’s earnings conference call and forward guidance.

There’s been discussion over whether Microsoft may temper its capex budget after two years of massive data center buildout.

CEO Satya Nadella said on the call that Microsoft opened 10 new data centers last quarter. Management expects capex to grow in fiscal 2026, albeit slower than in 2025.

Microsoft’s CFO Amy Hood also said Azure should deliver solid fiscal fourth-quarter growth of 34% to 35%.

Revenue in its Intelligent Cloud segment is forecast to be between $28.75 billion to $29.05 billion, representing 21% to 22% year-over-year growth.

Overall, Microsoft is guiding for total revenue of $73.15 billion to $74.25 billion for the quarter.