STORY: There were conflicting outlooks from Big Tech on Thursday.

Google-parent Alphabet cheered investors when it said AI investments were now powering returns at its ad business.

Chief Executive Sundar Pichai said the new tech was also helping in search.

He said 1.5 billion people per month were using its AI Overviews – that’s the summaries that now appear above the usual list of links.

Overall profit and sales both beat forecasts, with revenue just topping $90 billion for the first quarter.

But the firm says it isn’t immune to global trade turmoil, with ad sales vulnerable after Donald Trump closed a loophole allowing small packages to be sent duty-free from China.

Industry data shows e-commerce giants Temu and Shein have sharply cut ad spending following the move, potentially hitting earnings for Google.

Even so, Alphabet shares jumped 4% in U.S. after-hours trade following the bullish outlook on AI.

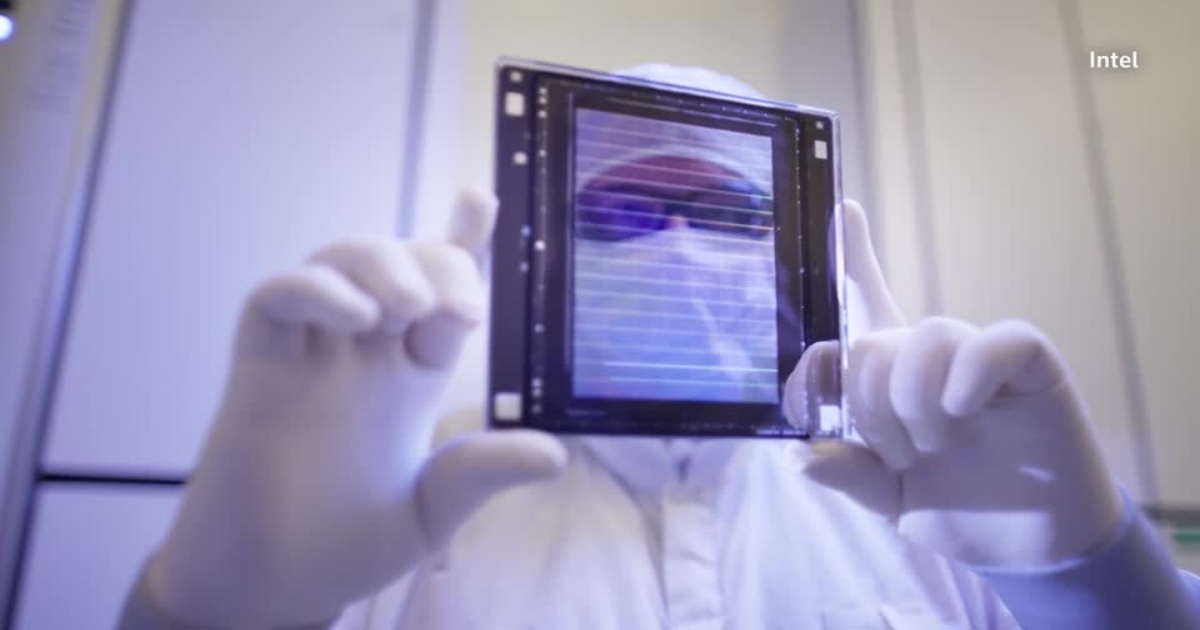

It was a different story for Intel, which forecast second-quarter profit and revenue below Wall Street expectations.

The chipmaker says tariff worries led customers to stock up on its chips over recent months, meaning sales in the coming period would see a corresponding dip.

The company called U.S. trade policies “very fluid”, and said they were among factors increasing the chances of an economic slowdown.

However, new chief executive Lip-Bu Tan hinted at plans for sweeping changes meant to refocus the firm on its engineering culture.

He also said he had met with the boss of Taiwan rival TSMC to look for areas of collaboration.

His comments appeared to limit after-hours losses for Intel shares, though they were still down around 5%.